why are reits tax efficient

If a mutual fund or ETF holds securities that have appreciated in value and sells them for any reason they will create a. REITs are tax efficient for many reasons.

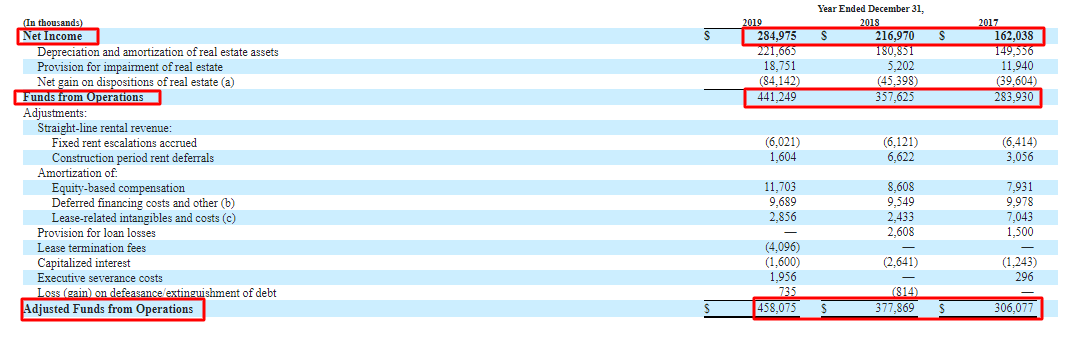

Reit Valuation Methods Metrics And Analysis Simplified

When looking at after-tax total returns the effective tax rate gap between REITs and corporates is typically much closer than generally perceived.

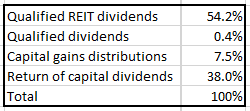

. Transfer of Assets to REITs. How are REITs taxed in 2021. TAX EFFICIENCY OF REITS Portions of distributions from Real Estate Investment Trusts REITs will be taxed at different rates depending on their characterization.

Their dividend tax rate is much higher than dividends on stocks. Theres another reason to put REITs in tax-advantaged accounts. Investments that are tax-efficient should be made in taxable accounts.

A REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing. In exchange for paying out at least 90 of taxable income to shareholders REITs gain tax-exempt status. While REITs may experience day.

A REIT is a tax-efficient vehicle that gives people. The 2017 Tax Cuts and Jobs Act also created a path for investors to transfer property via Delaware statutory trust to a REIT in exchange for shares equal to the. - Ordinary Income - Capital.

REIT dividends are cash distributions to REIT shareholders. ETFs are vastly more tax efficient than competing mutual funds. But by significantly reducing the rates on ordinary REIT dividends.

The majority of REIT dividends are taxed as ordinary. REITs Can Enter Real Estate Related Businesses to Boost Returns. REITs offer incredible tax advantages.

Their dividend tax rate is much higher than dividends on. For example they dont pay corporate income taxes return of capital distributions are tax-deferred and REIT investors can deduct. The good news is that tax-efficient investing can minimize your tax burden and maximize your bottom linewhether you want to save for retirement or generate cash.

REITs receive special tax treatment--the deduction of dividend payments on their corporate income. Check out our dedicated page on REITs here for more information. When you hold shares of a REIT you are an actual owner of real estate.

REITs by their very structure are not particularly tax-efficient As long as a REIT pays out more than 90 of net income it pays NO. REITs are a tax-efficient diversified. For the average investor the slightly higher effective tax rate on REITs 19 vs 15 is outweighed by the diversification and operational advantages of holding REITs.

Most investors were paying significantly higher effective tax rates on REIT income than on qualified dividends. REITs distribute almost all of their profits as dividends. Why are REITs tax efficient.

REIT dividends are typically non-qualified dividends meaning they are. Since REITs are required to distribute 90 of their annual taxable income to investors REITs are allowed to avoid taxation.

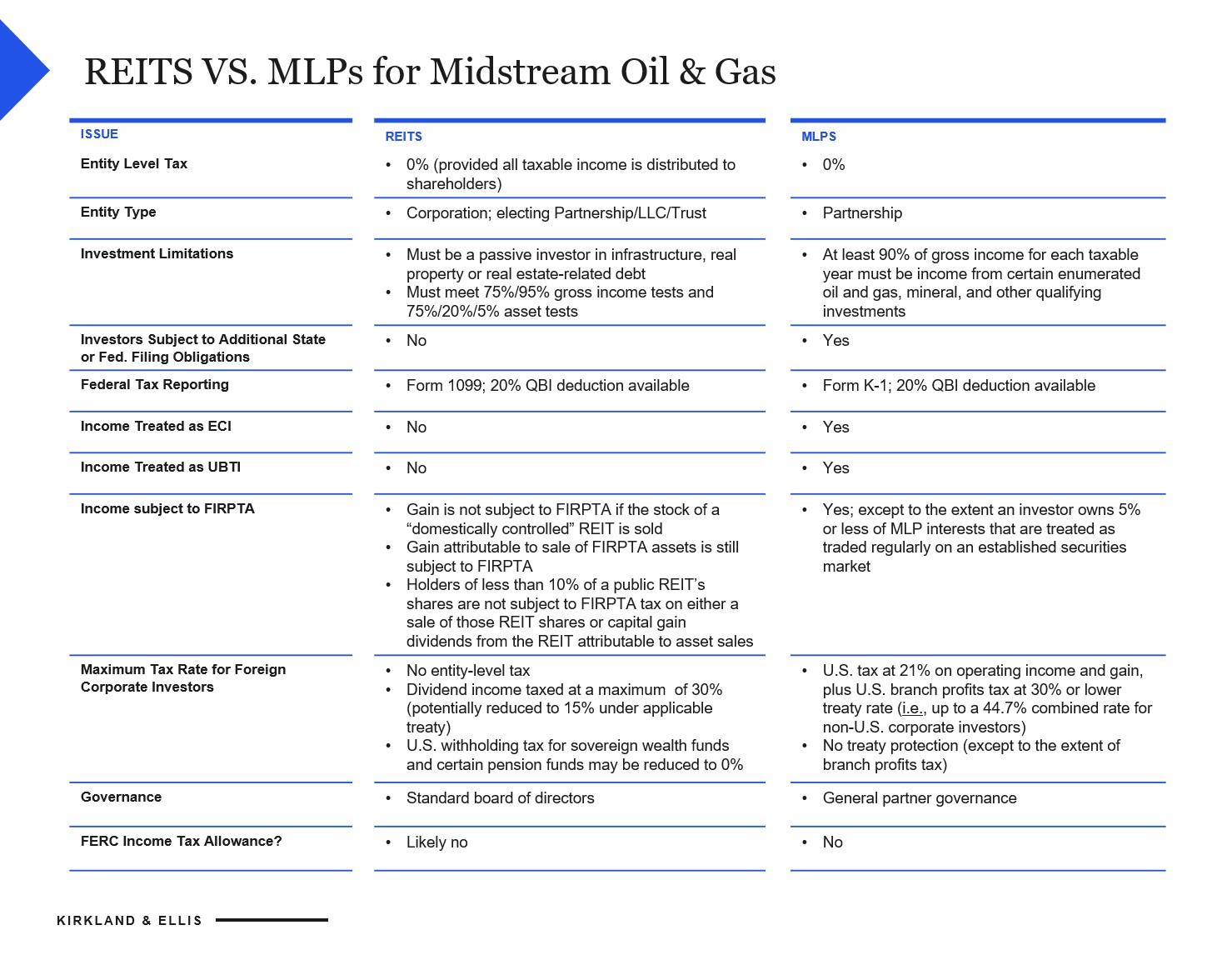

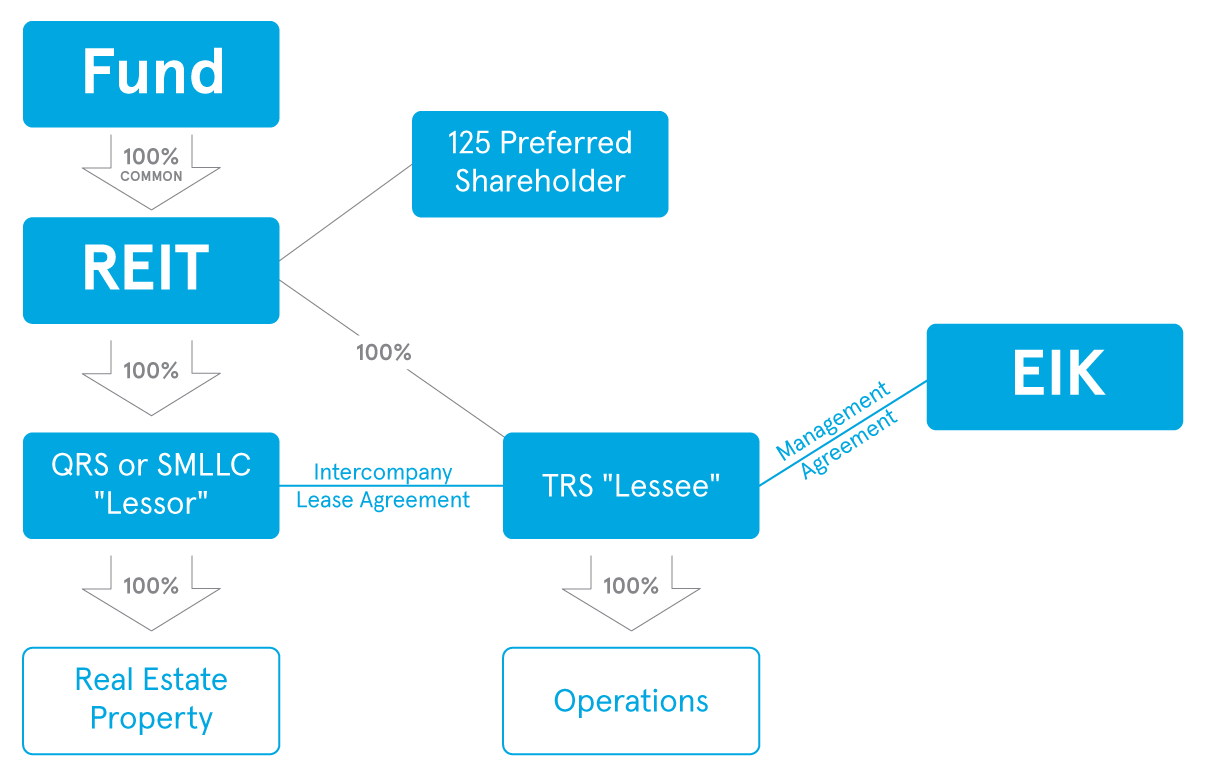

Taxable Reit Subsidiaries Q A Primer

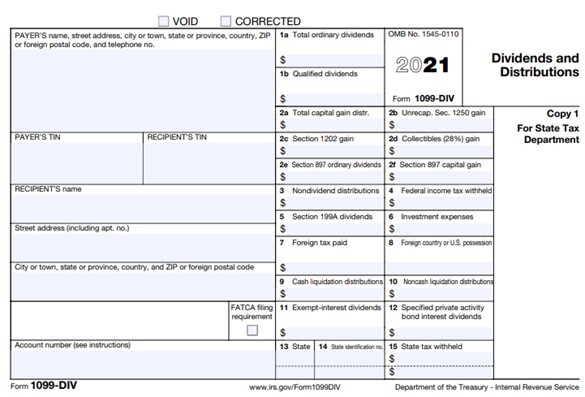

Reit Tax Advantages Demystifying Your 1099 Div

Are Reits As Attractive As We All First Thought Financial Times

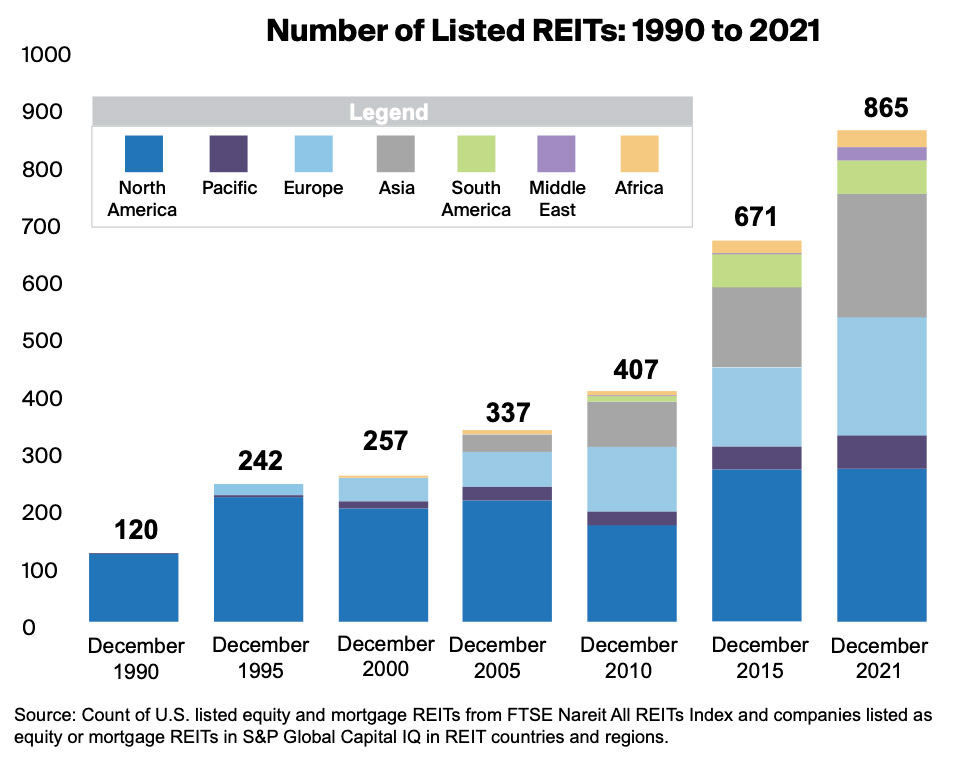

Global Real Estate Investment Nareit

The Continuing Rise Of The Reit

Yield Split Method Of Asset Location To Reduce Tax Drag

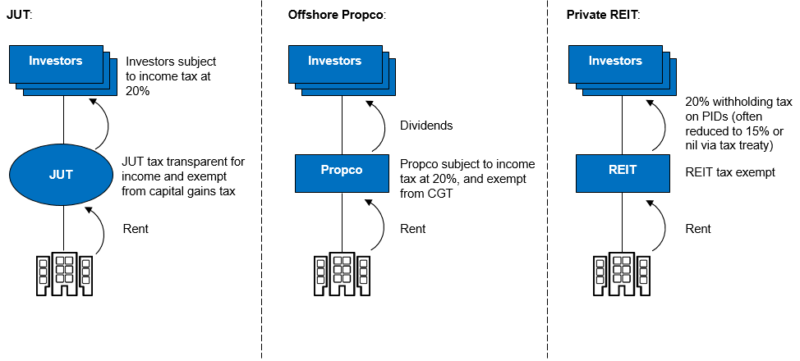

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

What Is A Reit Reit Tax Advantages Cpa Firms Atlanta Ga

Qoz Investing Reits Versus Llcs As Fund Structures Origin Investments

How To Value Reits In 2022 Real World Examples

Tax Efficiency Effective Strategies For The Short Term Bny Mellon Wealth Management

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

The Key To Tax Efficient Investing Asset Location

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

Real Estate Investment Trusts What Are Reits

Advantages Of Reits In A Taxable Account Seeking Alpha

Investing In Reits Real Estate Investment Trusts Block Ralph L 9781118004456 Amazon Com Books

Tax Efficiency For Holding Reits In Rrsp Accounts R Personalfinancecanada